What features of your product do customers value most? If you wanted to enhance your product, what benefits should be added and/or removed? Your customer satisfaction surveys show that customers rate all your product’s features very highly. But do they value each feature to the same degree? How do you determine their most treasured product attributes?

Consumer choice decisions have long been of interest to economists and market researchers, and several approaches have been developed to help decisionmakers zero in on product features customers “must have” and/or “couldn’t care less” about. These approaches are known as discrete choice models. And one of the most popular discrete choice methods is MaxDiff Analysis.

MaxDiff Analysis Explained

MaxDiff analysis, like other discrete choice methods, is built into surveys through a series of questions. A product could have 10 key features, but the manufacturer often wants to know the specific features customers value most, so it makes use of surveys in which participants are shown a random set of four to six of those features in one question. Out of that set, the participant selects the feature s/he prefers most (or considers the best) and the feature s/he prefers least (or considers the worst). Then the participant is shown another set, which can include some of the features in the previous set but shows one or more of the other features. The participant chooses his/her most and least preferred feature in that set, and so on. Because only one feature in the set can be the participant’s most preferred and only one can be his/her least, the participant’s choice is discrete.

Example: A new small business checking account

As an example, let’s assume a community bank wants to offer business customers a small business checking account. The bank wants to see which of the following 10 features its customers would value most when selecting a checking account for their businesses:

- 100 transactions per month with no fee

- $20 monthly service fee, waived if $10,000 or more in average beginning day balances is maintained each day

- Up to $30,000 in cash deposits per statement cycle at no charge

- 4 ATM surcharge reimbursements per month, up to a maximum of $20

- No charge for all incoming wire transfers and two outgoing wire transfers per statement cycle

- Interest paid on balances above $25,000

- Complimentary fraud protection services

- Complimentary online bill payment

- On-the-go banking with a mobile app

- $5 monthly statement credit for paperless statements

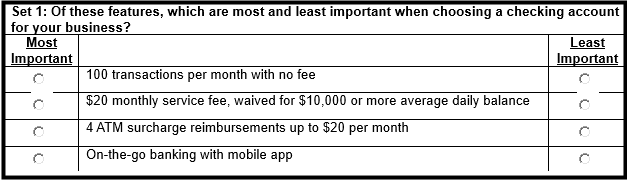

The bank retains a marketing research firm to field a survey. Using MaxDiff, the marketing research firm structures a question using the following set of four of the above features:

A survey participant will then select the feature most important to him/her, and the feature least important. Perhaps the participant will respond that the $20 service fee is most important and the mobile app least important. In that situation, the participant’s values are clear:

Monthly service fee –> 100 free monthly transactions and 4 ATM surcharge reimbursement –> Mobile app.

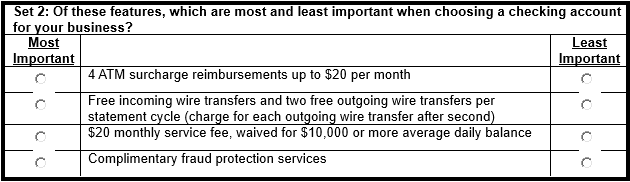

After this, the participant is shown the next set:

If the participant again selects $20 service fee as most important, and then chooses the wire transfers feature least important, we then know the customer values are as follows:

Monthly service fee –> Fraud protection and 4 ATM surcharge reimbursement –> Wire transfers.

The participant is shown more sets of these features, and as s/he progresses through them, the bank will get a fuller picture of his/her most important features.

Analyzing the Results

Once the data is collected, the marketing research firm will score the preferences. In most situations, the firm will make use of statistical approaches like linear regression or Bayesian rating systems, both of which can get complex, cumbersome, and will often require highly specialized software to compute. Often, a simple computation of best/worst ranking will do the job well and is much easier to explain and interpret.

Best/worst ranking is simply taking the number of times a feature was rated best, then subtracting the number of times the feature was rated worst, and then dividing the difference by the number of times the feature had been shown to survey participants. Multiply that by 100. This will result in a value between -100 and +100, with the negative numbers indicating that more participants rated the feature as least important, and positive numbers indicating more participants rated the feature most important. Then, each feature is ranked by its score.

Using the small business checking account example, let’s say the $20 service fee was shown to survey participants a total of 1,000 times. Participants indicated this feature was their most important feature 400 times, and their least important feature 200 times. Hence, we calculate it’s best/worst ranking:

100 X (400 – 200)/1,000

=20

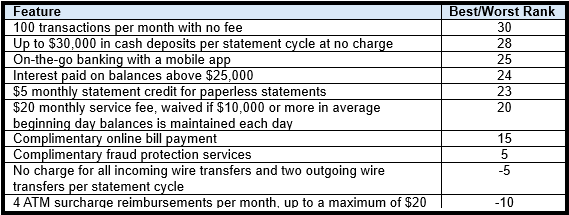

The fact that the best/worst score for the $20 service fee feature was 20 suggests that it was viewed as most important more often than least important by survey respondents. But by itself, this doesn’t mean anything, so the marketing research firm will compute the scores for each feature and rank them from best-to-worst or most-to-least important, like below:

Looking at the results in this fashion tells the bank that survey participants place the highest values on the free 100 transactions each month; being able to deposit up to $30,000 in cash each month without a fee; the mobile app; and the prospect of earning interest on balances above $25,000. Respondents seem least interested in fraud protection services, wire transfer fees, and ATM surcharge reimbursement.

Cautions about MaxDiff Analysis

In general, these findings would suggest that survey respondents have a lot of banking transactions each month and deposit a lot of cash, and value speedy banking, and are not concerned about wire transfer feeds and fraud protection.

Not necessarily.

Just because some features are rated least important doesn’t mean they are unimportant! Fraud protection is very important in today’s high-tech world. It could very well be that respondents rated that feature as least important because they expect the bank to provide it anyway.

In addition, we must consider the presence of subgroups within the survey respondents. Small business owners in urban areas with a lot of traffic will likely have different banking needs than business owners in suburban, exurban, or rural areas. Moreover, hospitality businesses will prioritize different small business checking features than industrial businesses.

Also, MaxDiff questions can be cumbersome to survey participants if not structured correctly. When being shown a set of attributes, it’s usually best to show between three and seven attributes per set (I would argue no more than five). These are usually good numbers for respondents to reasonably choose their least and most favorite features. Having multiple sets of 10 or 15 features can easily confuse and fatigue respondents.

Finally, showing all possible combinations of features is rarely feasible, and is often overkill. Depending on the number of features you want to test, and the number of features shown in each set, the number of combinations can become astronomically high: in the small business checking example, there would be 210 possible sets to check! Fortunately, each respondent can be shown just a random selection of these sets (about 10 or 15), and the results should still be accurate with high confidence.

Conclusion

MaxDiff Analysis is an intuitive, useful quantitative tool that can assist companies with product development, customer segmentation, marketing research, and pricing research. By requiring survey respondents to choose their absolute most and least favorite features over several sets, it becomes easy to see what your customers prioritize in a product.